📢 Sign up to my newsletter and never miss a beat!

In this article, we`re going to look at one crucial aspect of product management and running successful products – managing product risks.

Risk management for software products involves identifying, assessing, and prioritizing risks throughout the software development lifecycle, to minimize, monitoring, and control the probability or impact of unfortunate events. This process is crucial for ensuring that a software project meets its objectives within scope, time, and budget constraints. Here are the key components and strategies involved in effectively managing the product risks:

- Risk identification

- Risk Assessment and Prioritization

- Develop Mitigation Strategies and Plans

- Communicating it to the team and frequent reassessment

Now, let`s have a look at each one separately and in more detail:

1. Risk Identification

The first step of managing product risks involves identifying the various risks that can occur. Of course, there are always risks you can`t anticipate and even imagine, but as long as you consider and are prepared for the most common ones, it`s fine. You don`t need to overcomplicate things and you probably don’t even have the time to think of all possible scenarios. Start by identifying the main types of risks in your product and industry. We can categorize them into the following categories:

- Market Risks

- Technical Risks

- Operational Risks

- Financial Risks

- Legal and Compliance

Here is a breakdown of what each of the above risk categories can mean and include:

1) Market Risks:

One of the biggest risks when launching or running SaaS products are Market risks. These are risks associated with things that are very often, out of our control as they reflect market and macro-economic conditions and the challenges that may arise from them. Here are some examples to consider when brainstorming on potential market risks:

- Market Saturation: As the SaaS market becomes increasingly crowded, new entrants might find it challenging to secure a unique position. Launching a product in an already saturated niche without a clear differentiator can limit its growth potential and sustainability.

- Underestimating Customer Acquisition Costs: The cost of acquiring new customers in competitive SaaS markets can be higher than anticipated, especially if market research fails to accurately gauge the effectiveness of marketing strategies or the intensity of competition.

- Failure to Adapt to Changes in Market Trends: The rapid pace of change in SaaS markets requires continuous innovation and adaptation. Failing to evolve the product in line with emerging market trends can lead to obsolescence.

- Customer Churn due to Market Dynamics: Even after a successful launch, maintaining customer loyalty can be challenging. Shifts in market dynamics, such as the entry of a superior product or a change in customer preferences, can lead to increased churn rates.

- Pricing Strategy Missteps: Setting the wrong price for a SaaS product can significantly impact its market acceptance. Pricing too high might deter potential customers, while pricing too low could undervalue the product and affect revenue potential.

- Impact of Global Events: Events such as political instability, economic recessions, or pandemics can have unforeseen impacts on market demand and customer spending habits, affecting the lifecycle of a SaaS product.

- Misreading Market Needs: A fundamental risk lies in the failure to accurately identify and understand the target market’s needs. Developing a SaaS product based on incorrect assumptions about what potential users want or need can lead to poor adoption rates and eventual failure.

- Reliance on a Single Market: Diversification is key to managing market risks. Relying too heavily on a single market for revenue can expose a SaaS business to significant risk if that market experiences a downturn.

- Barriers to Market Entry in New Regions: Expanding into new geographic markets can be fraught with challenges, including cultural differences, localization requirements, and local competition. Underestimating these factors can impede successful market entry and growth.

- Fluctuations in Currency Exchange Rates: For SaaS companies operating internationally, fluctuations in currency exchange rates can affect pricing strategies and profitability in different markets, potentially making a product less competitive in regions where the currency has weakened against the dollar.

- Erosion of Competitive Advantage: Initially unique features of a SaaS product can quickly become standard as competitors emulate successful elements. The erosion of these unique selling points can dilute a product’s competitive advantage, impacting its market position.

- Reputation Risks from Product Failures: Any significant downtime, data breaches, or other product failures can quickly tarnish a SaaS company’s reputation, leading to loss of trust among current and potential customers, which is particularly amplified in today’s connected and social media-driven market.

- Dependency on Third-Party Platforms: SaaS products relying on third-party platforms (like marketplaces or cloud services) face the risk of changes in terms, increased fees, or even discontinuation of essential services, which can directly impact their market viability.

2) Technical Risks

Technical risks in the context of SaaS (Software as a Service) encompass a wide array of challenges that can impact the development, deployment, and maintenance of the software. These risks are intrinsic to the technical aspects of the software’s lifecycle and infrastructure. Examples include:

- Cybersecurity Threats: The risk of data breaches, hacking incidents, ransomware attacks, or other forms of cyberattacks. This includes vulnerabilities in the software itself or in third-party services it integrates with.

- Downtime and Availability Issues: Risks related to system outages, server failures, or other incidents that can lead to the SaaS product being temporarily unavailable to users. This can be caused by infrastructure failures, software bugs, or external attacks.

- Scalability Challenges: The ability of the SaaS infrastructure to handle growth in users or data volume without performance degradation. This includes challenges in scaling up resources or optimizing the application’s architecture to support increased loads.

- Technology Obsolescence: The risk that the technology stack the SaaS product is built on becomes outdated, unsupported, or incompatible with newer systems and standards, necessitating significant updates or a complete overhaul.

- Data Integrity and Loss Risks: Challenges related to ensuring the accuracy, consistency, and safety of user data. This includes risks of data corruption, unintended data loss, or failures in backup and disaster recovery mechanisms.

- Interoperability and Integration Challenges: The difficulty in ensuring that the SaaS product can seamlessly integrate with other tools, systems, or APIs that customers use. This includes challenges related to data formats, communication protocols, and compatibility.

- Performance Bottlenecks: Issues that lead to slow response times or poor application performance, affecting user satisfaction. This can be due to inadequate hardware resources, inefficient code, or poorly designed database queries.

- Dependency Risks: The risk associated with relying on third-party libraries, frameworks, or services that may become deprecated, unstable, or insecure. This includes risks from changes to APIs or terms of service that can disrupt the SaaS product’s functionality.

3) Operational Risks:

Operational risks for SaaS products encompass a broad range of issues that can affect the internal processes, people, and systems of an organization, thereby impacting its ability to deliver services efficiently and effectively. Unlike market, technical, financial, or legal and compliance risks, operational risks are more focused on the internal efficiencies, processes, and procedures of the organization. Here are examples of the most common operational risks that normally occur:

- Human Resources Risks: Challenges related to staffing, such as high turnover rates, difficulties in hiring skilled personnel, or inadequate staff training and development. This can impact the quality and continuity of service delivery.

- Project Management Risks: Failures in managing projects, including poor planning, scope creep, or inadequate project monitoring and control. These risks can lead to delays, cost overruns, and failure to meet client expectations.

- Processes Risks: Poor or no processes in place, or no algorithms of action, to navigate employees through the workflow or execution of tasks that can cause confusion, resulting in not knowing how to act.

- Quality Control Risks: Failures in maintaining the quality of the service or product, which can lead to customer dissatisfaction, increased churn rates, and damage to the company’s reputation.

- Communication Risks: Poor internal or external communication practices, leading to misunderstandings, misaligned objectives, or inefficiencies in operation. This can affect both team dynamics and customer relationships.

- Vendor Management Risks: Challenges associated with managing third-party vendors, including dependency on single vendors, poor vendor performance, or contractual disputes. This can affect service delivery and operational efficiency.

4) Financial Risks

Financial risks companies encompass a range of challenges that could impact the financial stability and growth potential of the business. The following examples encompass some possible risk scenarios:

- Revenue Recognition Issues: SaaS companies often face complexities in revenue recognition due to subscription-based models. Misjudging the timing and amount of revenue recognized can lead to financial discrepancies and affect the company’s financial health.

- Exchange Rate Fluctuations: As discussed in the market type of risks, adverse movements in exchange rates can erode profit margins and affect the company’s ability to budget and plan financially.

- Cash Flow Management: The subscription model of SaaS product businesses can lead to unique cash flow challenges. High upfront costs for customer acquisition and delayed revenue recognition can strain cash flow, especially in the early stages of the business.

- Customer Churn: While not exclusively a financial risk, customer churn has direct financial implications. Losing subscribers not only impacts revenue but also increases the pressure to spend more on marketing and sales to replace lost customers.

- Debt Financing Risks: Product and SaaS companies may rely on debt financing to fuel growth. However, the terms of debt and the company’s ability to meet repayment obligations can pose significant financial risks, especially if revenue growth slows or if the cost of capital increases.

- Investment in Research and Development (R&D): Product companies must continually invest in R&D to stay competitive. Misallocation of resources or failure to achieve expected outcomes from these investments can lead to financial losses.

- Pricing Strategy Risks: Setting the right price for SaaS products is critical. Underpricing can leave money on the table and strain financial resources, while overpricing can lead to reduced market share and revenue.

- Cost Overruns in Product Development: Developing new features or platforms can sometimes exceed budget expectations. These overruns can affect profitability and the availability of resources for other strategic initiatives.

- Impact of Economic Downturns: Another type of risk that can also be referred to as a Market risk. Economic downturns can lead to reduced spending by customers, affecting subscription renewals and new sales. SaaS companies must manage their finances to withstand periods of economic uncertainty.

- Taxation Issues: Navigating the complex landscape of international, federal, and state taxes can pose significant financial risks, especially for SaaS and product companies with a global customer base. Changes in tax laws or failure to comply with tax regulations can result in fines and penalties.

5) Legal and Compliance Risks:

Given the global nature of the software market, SaaS providers must navigate a complex web of laws and regulations that can vary significantly from one jurisdiction to another. Among some of the many are regulatory specifics and changes, licensing issues, privacy concerns, etc. Below are examples of Legal and Compliance Risks:

- Data Protection and Privacy Laws: Compliance with international data protection regulations such as the General Data Protection Regulation (GDPR) in the European Union, the California Consumer Privacy Act (CCPA), and other similar laws worldwide. These regulations mandate how companies should handle personal data, requiring measures for data protection, user consent, and data breach notification.

- Intellectual Property (IP) Violations: Risks of infringing on the intellectual property rights of others, including using proprietary code without permission, patent infringement, or not properly licensing third-party software components.

- Export Controls and Sanctions: Compliance with international export control regulations and sanctions, which restrict the sale, supply, transfer, or export of software and technology to certain countries, entities, or individuals.

- Accessibility Requirements: Ensuring the software is accessible to users with disabilities, in compliance with regulations such as the Americans with Disabilities Act (ADA) in the U.S. or the Web Content Accessibility Guidelines (WCAG) globally.

- Electronic Signatures and Records: Adhering to laws governing electronic transactions and signatures, such as the Electronic Signatures in Global and National Commerce Act (E-SIGN) in the U.S. and the Electronic Identification, Authentication and Trust Services (eIDAS) regulation in the EU.

- Anti-Bribery and Corruption Laws: Compliance with laws designed to combat bribery and corruption, such as the Foreign Corrupt Practices Act (FCPA) in the U.S. and the UK Bribery Act, especially relevant for companies operating in multiple countries.

- Consumer Protection Laws: Adhering to laws protecting consumers from unfair, deceptive, or fraudulent practices, including terms of service, advertising, and communication with users.

- Industry-Specific Regulations: Compliance with regulations specific to the industry a SaaS provider serves, such as the Health Insurance Portability and Accountability Act (HIPAA) for health information in the U.S., or the Financial Conduct Authority (FCA) regulations for financial services in the UK.

- Cross-Border Data Transfer: Compliance with regulations governing the transfer of data across borders, such as the GDPR’s requirements on data transfer outside the EU.

2. Risk Assessment and Prioritization

Once we have brainstormed what the various possible risks for our product and business can be, it`s time to concentrate on and narrow our attention down to the most impactful and important ones, which will allow us to later come up with an effective risk mitigation plan and processes without overcomplicating our lives. Action plans and mitigation strategies and measures are only created for those risks that have been prioritized. In order to come up with this shortlist of prioritized risks, we will assess the ones we brainstormed in the previous step to see which ones are worth our attention and further consideration.

There are various way of assessing product risks and each company might have their own methods and procedures in place. In general, there is a common rule that in order to evaluate a certain risk, one should consider the two factors of probability of occurrence and impact. These are the two variables that most companies use in one way or another.

One of the most popular risk assessment tools is the probability/impact matrix, illustrating the two factors of probability and impact on two separate axes. For each risk you`re looking at, you`ll assess what is its level on the two axes and place it on the matrix accordingly. This will help you get a visual representation of its risk profile. Those risks that have been placed on the lower quadrants of probability of occurrence and impact, are those of least importance for the business, whereas those that fall into the quadrants mid-to-high probability/impact, are the ones you may want to prioritize.

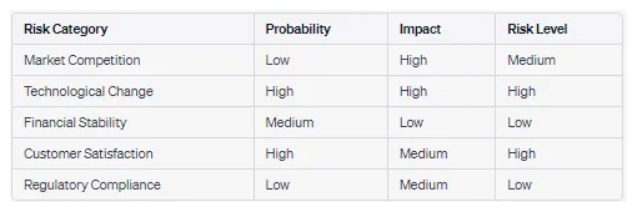

If it is more convenient for you, can also distribute the risks on an excel table, like the image below and work from there:

These methods are the most simple ones and might work well if you just want to do a quick product risk assessment without quantifications or other complex calculations , but bear in mind that due to their simplicity, they have their own limitation, such as a general lack the needed level of specificity to enable accurate risk ranking and high subjectivity. Nevertheless, as I already said, it can work just fine in many cases given all the other job responsibilities that the product management team and product managers in particular have. Because this article is mainly about guiding you through the process of how to effectively manage product risks and it addresses the needs and the role of the product managers, I will not overcomplicate it with additional factors like the timing attribute of each risk and other specifics, as these are normally covered by another role (risk managers) and used in other, more complex landscapes and industries.

The risk assessment method that I use is not overcomplicated with additional variables and factors that are subcategories of impact and probability, but at the same time it is not as simple as a probability/impact matrix with its three levels of risk categories (low, mid and high). The main difference is that I quantify the impact and the probability factors. Even though the values attached to them are still dictated by my own subjective judgement, this technique provides additional risk levels that can be accounted for, especially if it is difficult to make up your mind between the standard three levels of low, mid and high. What is more, you can always split the quantification you are using into different tiers and attach meanings to each. For example, if you are using a quantification model with values ranging from 1 to 5, with 5 representing the highest risk level, you can decide that each of the five values will represent different tiers that reflect particular situations or risk conditions, such as:

5 = the anticipated impact is likely to lead to massive revenue decrease by X%

4 = the impact is evaluated to cause churn rate ranging from X% to Y%, or revenue decrease by X% amount; OR, The event might lead to huge impact on the product reputation; OR…

3 = ….

2= ….

1= …..

(At each level/tier you can attach multiple situations)

Here is my step-by-step process of risk assessment and prioritization:

1) Impact Assessment

After I have identified and categorized all risks accordingly (whether they are technical, market, regulatory, etc), I want to assess the impact the occurrence of the risk event would have on the product and the business. Here, you can create impact categories (not to be confused with risk categories) that would tell us what areas of the product/business will be affected in case of the risk occurring. Creating impact categories would help us quantify the impact more effectively (especially if we`re splitting the values into multiple tiers) and make up our mind on what values make the most sense to be attached to each of the risks. Here is an example of some impact categories you can have (in many, but not all cases, they will be the same as the risk categories we`ve discussed earlier):

- Financial: Loss of revenue, increased costs, fines, etc.

- Operational: Disruptions to operations, loss of productivity, etc.

- Reputational: Damage to brand image, customer trust, etc.

- Strategic: Impacts on long-term goals, market position, etc.

The next step of risk assessment and prioritization is to do the actual quantification of the risk impact. As already mentioned, I would use the scale 1 to 5, with 1 being of least impact and 5 meaning highly impactful, or a percentage measure with 100% being the most impactful. You can evaluate each risk impact either based on the impact categories it falls into, or consider the risk impact on its own with all its individual characteristics and specifics.

2) Probability Assessment

Estimate the likelihood of the risk occurring within a specific timeframe. Here again, probability can be expressed as a percentage (0% to 100%) or on a scale (e.g., 1 to 5, where 1 is unlikely and 5 is very likely). It`s up to you which one you`ll choose to use, but bear in mind it should be the same type of measure you`re using to assess the Impact. Otherwise, the two factors that tell us what the total risk value of an event is, won`t be consistent and the final estimations will be wrong, leading to prioritizing the wrong risks.

3) Calculate the Total Risk Value (TRV)

To come up with the total risk value of each risk, which will then tell us which risks should we focus on creating mitigation strategies for, we will use the following formula, where you`ll multiple the values you`ve attached to the Risk Impact and Risk Probabilty:

Total Risk Value (TRV) = Impact X Probability

Once you calculate the TRV for all risks, you can do the prioritization step. Those with the highest TRVs are the most crucial ones as there is a higher probability for them to occur and the impact they can have on your product`s successfulness and your business would be more severe.

3. Develop Risk Mitigation Strategies and Plans

In managing product risks, identifying, evaluating and prioritizing potential risks is crucial, but not enough. Without the other step that follows: developing and implementing strategies to manage or mitigate these risks, the whole exercise becomes useless. A comprehensive approach to risk management involves both ante-factum strategies, which are proactive measures taken before a risk materializes with the aim of decreasing the chances of it happening or reducing its impact should it occur, and post-factum strategies, which are reactive measures taken after a risk has impacted the project, for which the plan of action had been drawn prior to it, so that the team would know how to act in situations when it kicks in.

Ante-factum Strategies

– Avoidance: The most straightforward way to deal with a risk is to avoid it altogether. This strategy involves altering the project plan to eliminate the risk or its potential impact. For example, if a particular technology poses significant risk due to its unproven nature, the project might pivot to a more established solution. Avoidance is particularly effective for risks with potentially catastrophic consequences, but it may also lead to missed opportunities.

– Reduction: When avoidance is not feasible, the next best strategy is to minimize the likelihood or impact of the risk. This can be achieved through implementing additional safety measures, enhancing quality controls, or providing additional training to the team. Reduction strategies require a careful analysis of cost versus benefit to ensure that the measures are economically viable.

– Transfer: Some risks are best managed by transferring them to a third party. This can be done through purchasing insurance policies or outsourcing certain tasks to specialists who are better equipped to handle specific risks. For instance, a project might outsource its cybersecurity needs to a firm specializing in digital security, thus transferring the risk of data breaches.

– Acceptance: Not all risks can or should be avoided, reduced, or transferred. In some cases, the best strategy is to accept the risk but prepare for its potential impact. This involves developing a contingency plan that outlines the steps to be taken should the risk materialize. Acceptance is a viable strategy for risks with low probability or impact, where the cost of mitigation exceeds the benefit.

Post-factum Strategies

– Contingency Planning: Despite the best efforts in risk management, some risks will materialize. Contingency plans come into play at this juncture, providing a predefined response to adverse events. These plans should be detailed, outlining specific steps, responsibilities, and resources required to mitigate the impact. Effective contingency planning ensures that the team can respond swiftly and efficiently, minimizing the disruption to the project.

4. Communicate the Risk Management Plan to the Team and Ensure Frequent Reassessment

1) Effective Communication of Risk Management Strategies

The success of risk mitigation strategies heavily relies on clear and effective communication to all team members involved in the project. Here is a breakdown of what it involves:

- Creating Awareness: Ensure every team member understands the potential risks, their impact, and the importance of the mitigation strategies in place. This fosters a risk-aware culture within the team.

- Clarity on Roles and Responsibilities: Define and communicate the specific actions and responsibilities assigned to team members in executing the risk mitigation plans. This includes who is responsible for monitoring each risk and who to report to if a risk materializes.

- Utilizing the Right Tools: Employ project management and communication tools that facilitate seamless sharing of risk assessments, updates, and contingencies. These tools should enable real-time updates and alerts to keep everyone informed.

2) Frequent Reassessment of Risks

Risks are not static; they evolve as the project progresses. Therefore, it’s essential to have a process in place for the ongoing reassessment of risks. This includes:

- Regular Review Meetings: Schedule periodic risk review meetings to assess the status of existing risks and to identify new risks. These meetings should evaluate if the likelihood or impact of risks has changed and adjust mitigation strategies accordingly.

- Adapting to Changes: Be prepared to update risk management plans as project scopes, environments, or external factors change. Flexibility and adaptability are key to responding to new challenges effectively.

- Learning from Experience: Encourage a culture of learning where team members share insights and lessons learned from managing risks. This collective knowledge can improve future risk management efforts.

3) Ensuring Continuous Improvement

The process of communicating and reassessing risks should not be seen as a one-time activity but as part of a continuous improvement cycle. This includes:

Feedback Mechanisms: Implement feedback loops where team members can voice concerns, suggest improvements, and provide updates on risk management efforts. This can help in refining strategies and making them more effective.

Documentation and Knowledge Sharing: Keep comprehensive records of risk management activities, decisions, and outcomes. This documentation can serve as a valuable resource for future projects, helping teams to anticipate and mitigate risks more effectively.

By emphasizing clear communication, assigning clear roles and responsibilities, and fostering an environment of continuous reassessment and improvement, teams can navigate project risks more effectively. This approach not only minimizes the impact of risks on the project but also contributes to building a resilient and adaptable team.

Want to Explore More on This Topic?

Delve deeper with these curated resources! Discover insightful articles, expert blogs, and top-rated books to enhance your knowledge and skills.

Note: Some links are affiliate links, which means I may earn a small commission if you decide to make a purchase.

- “Risk Assessment Framework: Successfully Navigating Uncertainty” by Ray W. Frohnhoefer

This book provides a comprehensive framework for managing risk in any initiative, from projects to operations. The book emphasizes the importance of a scalable and adaptable approach to risk management, offering tools, techniques, and templates to help organizations proactively manage risk1. It includes guidance on tailoring the framework to specific needs, conducting risk assessment workshops, and aligning with standards like PMBOK and ISO 31000. The revised edition also highlights positive risks and how effective risk management can pay for itself - “Managing the Unknown: A New Approach to Managing High Uncertainty and Risk in Projects” by Christoph H. Loch, Arnoud DeMeyer, and Michael Pich offers a fresh perspective on managing projects in uncertain and novel environments. The book introduces two key approaches: Trial-and-Error Learning, which allows for redefining plans as the project unfolds, and Selectionism, which involves pursuing multiple independent trials to select the best outcome. It provides causal explanations, management tools, and real-world case studies to help managers navigate unforeseen challenges in high-uncertainty projects.